EMPLOYEE FINANCIAL WELLNESS REPORT 2025

Payroll Integrations’ Employee Financial Wellness Report explores the growing importance of financial wellness from the perspective of both employers and employees.

The second installment of Payroll Integrations’ 2025 Employee Financial Wellness Report reveals a workforce that values stability—and the benefits that make it possible.

.png)

What’s Keeping Employees Around?

More Than Half Say Health, Retirement and Family Benefits

Payroll Integrations’ 2025 Employee Financial Wellness Report reveals a workforce that’s finding stability not in the job market, but in their benefits. More than half of employees (58%) are staying in their current roles because of the health, retirement and family benefits they receive, an indication that as economic uncertainty grows, benefits have become a primary anchor of retention.

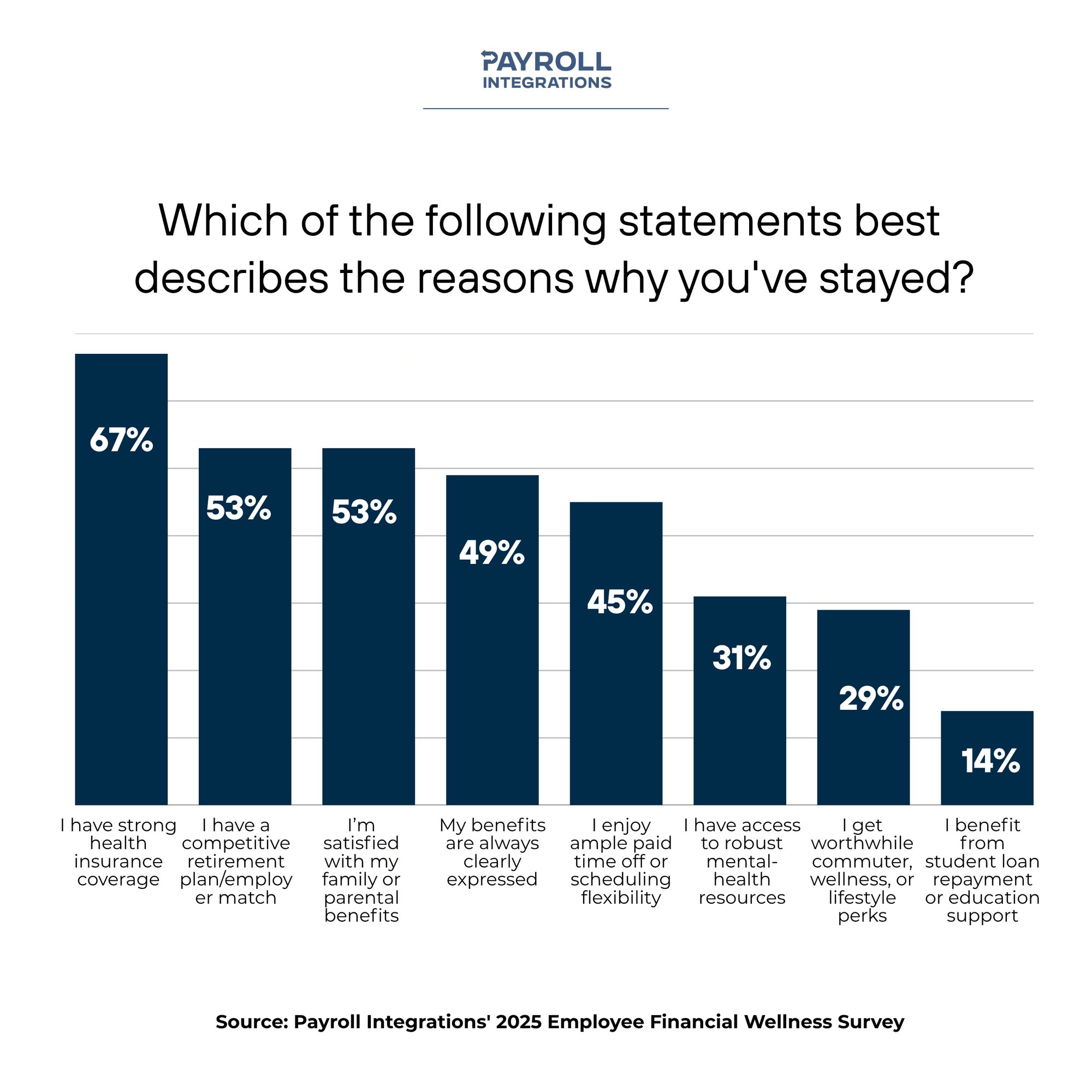

Among those who cite benefits as a reason to stay in their current jobs, 67% point to strong health insurance coverage, while 53% name competitive retirement plans and family-related benefits as their primary reason to stay. This shift signals that, for many employees, benefits have evolved from a perk to a critical form of financial protection.

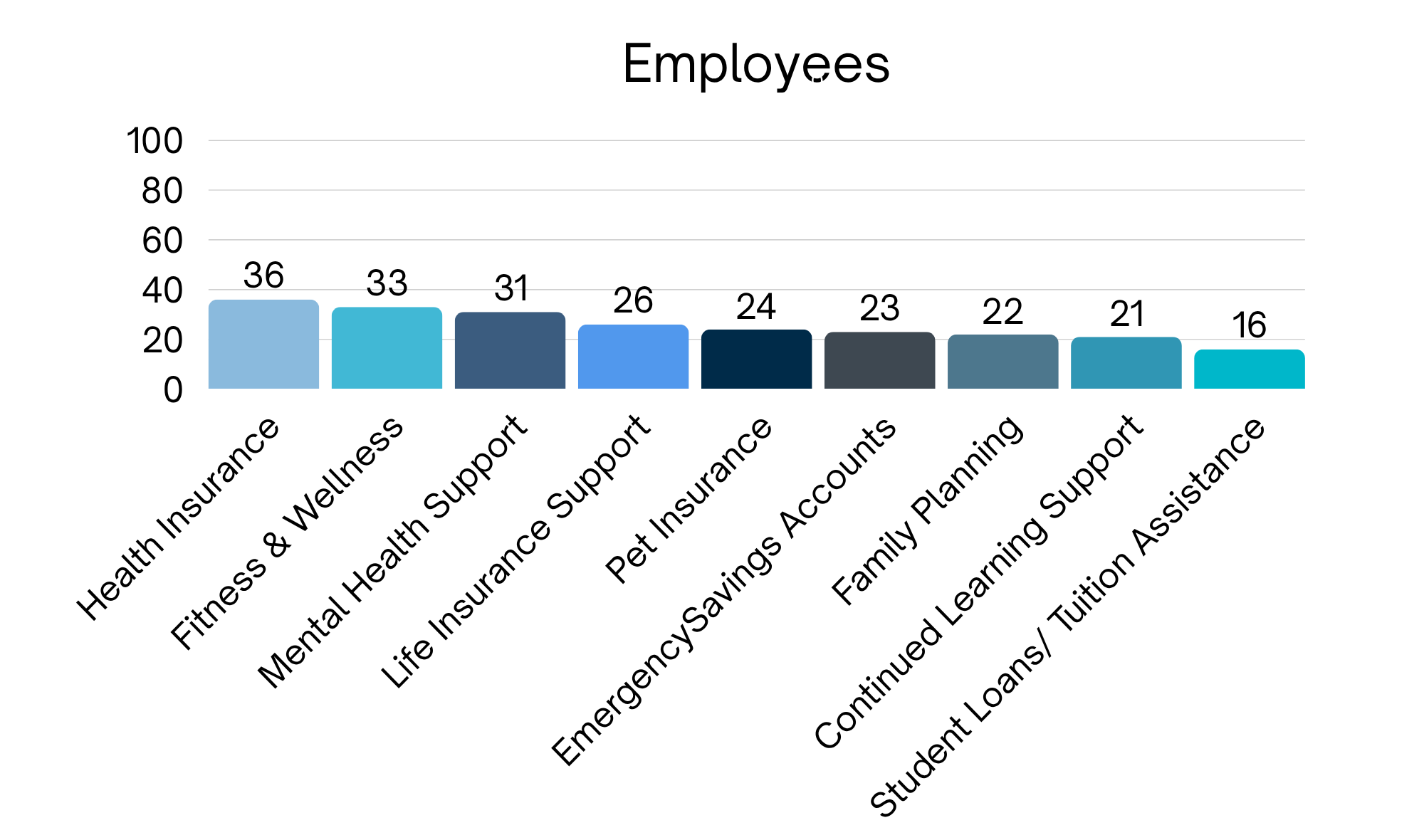

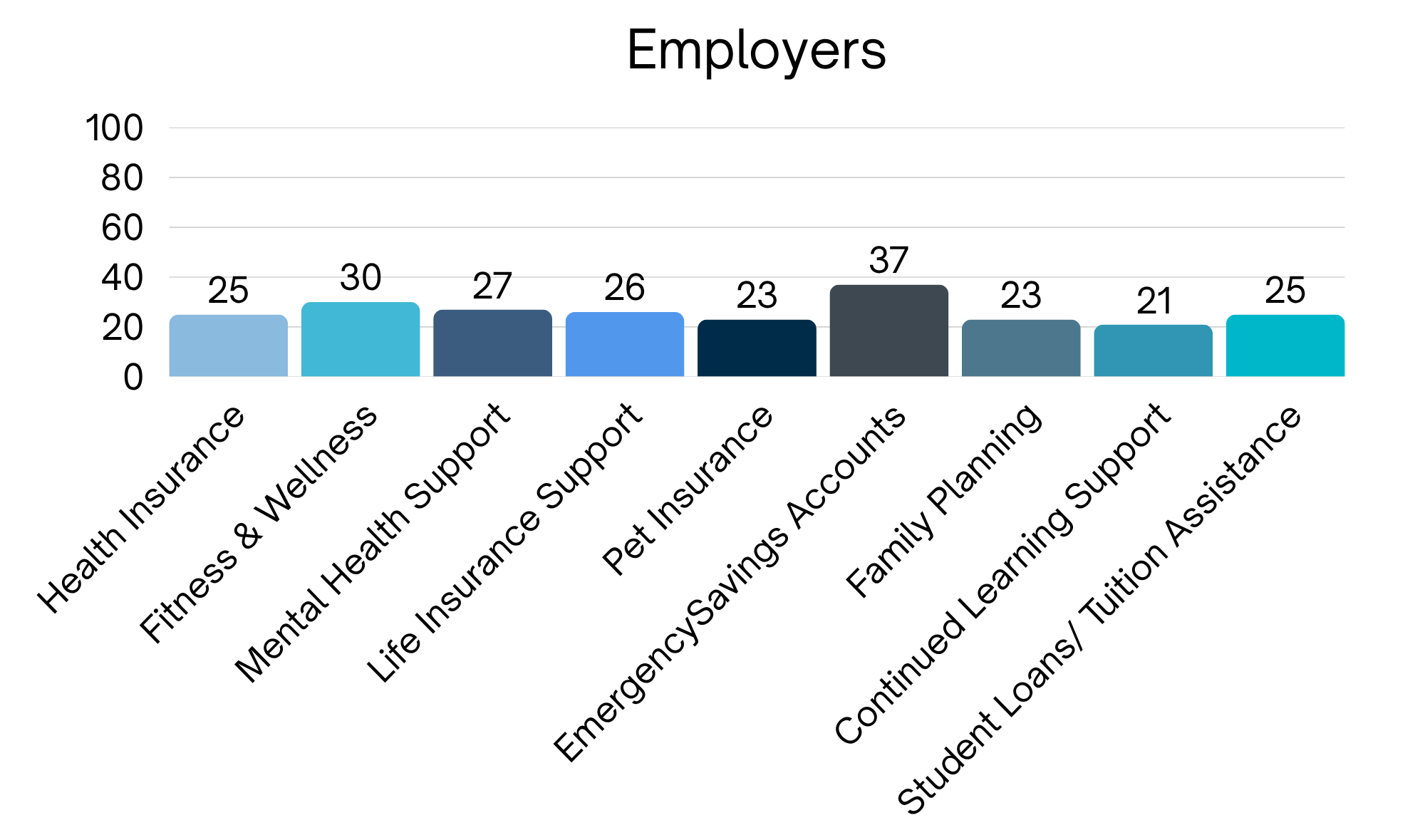

The findings also underscore a growing confidence gap between employees and employers. 42% of employees say their benefit needs are fully met with their current package. When asked which benefits would better support them beyond what’s currently offered, employees name financial and wellness compensation (33%), additional pay (32%) and mental health support (31%) as their top priorities after healthcare and retirement.

Employers, on the other hand, rank childcare assistance, emergency savings accounts and health savings accounts as key additional offerings. This highlights a clear disconnect between what employers think employees value and what employees actually prioritize.

Key Findings:

of employees are staying in their current job because of their benefits

of employers admit they could do more to support financial wellness

of employees feel fully supported in their financial wellness

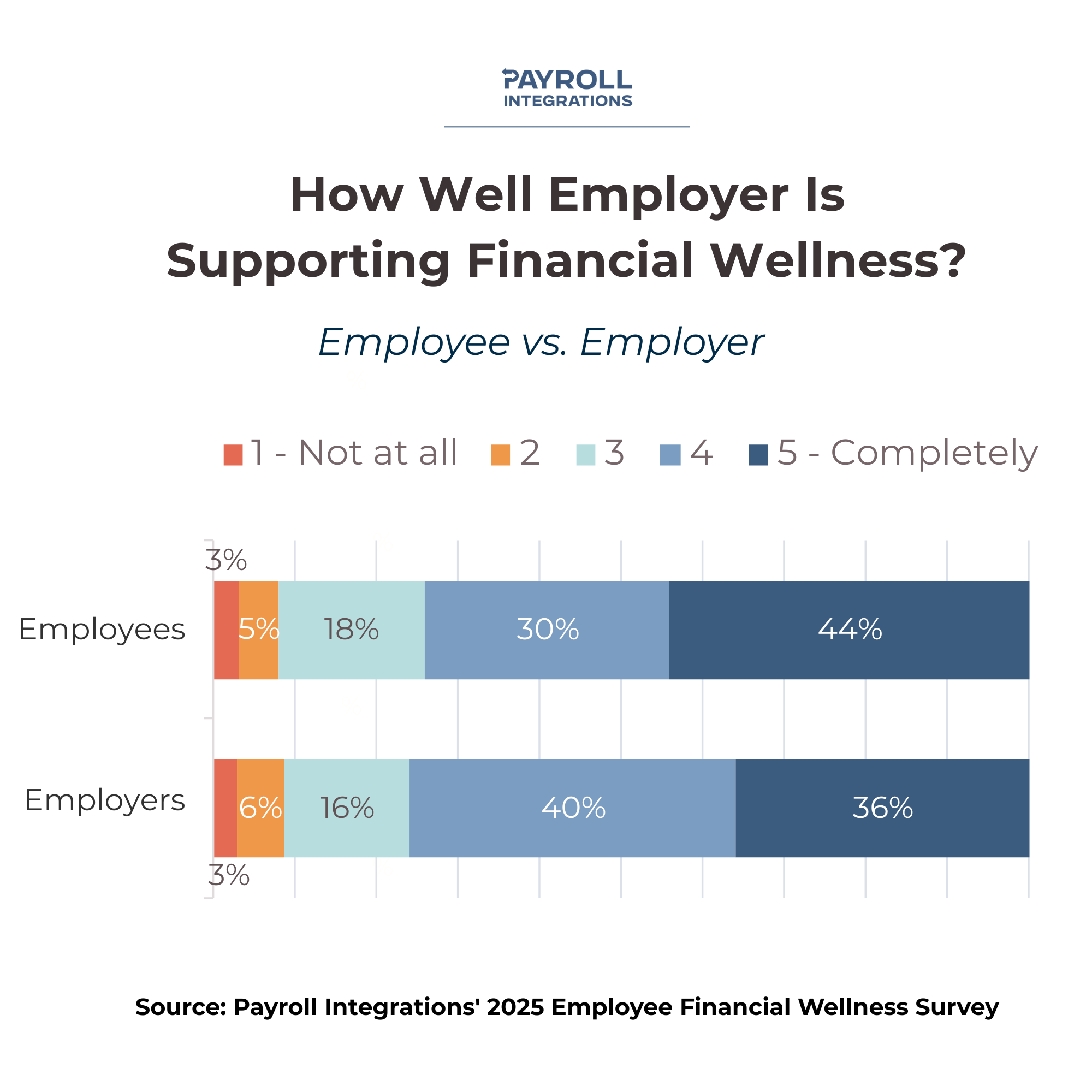

How Well Are Employers Supporting Financial Wellness?

44% of employees feel completely supported by their employers in regards to financial wellness, while only 36% of employers believe their companies are completely supportive of employees’ financial wellness.

What Employees Want vs. What Employers Think They Want

What benefit offerings, that employer doesn’t already offer, would more effectively meet current needs?

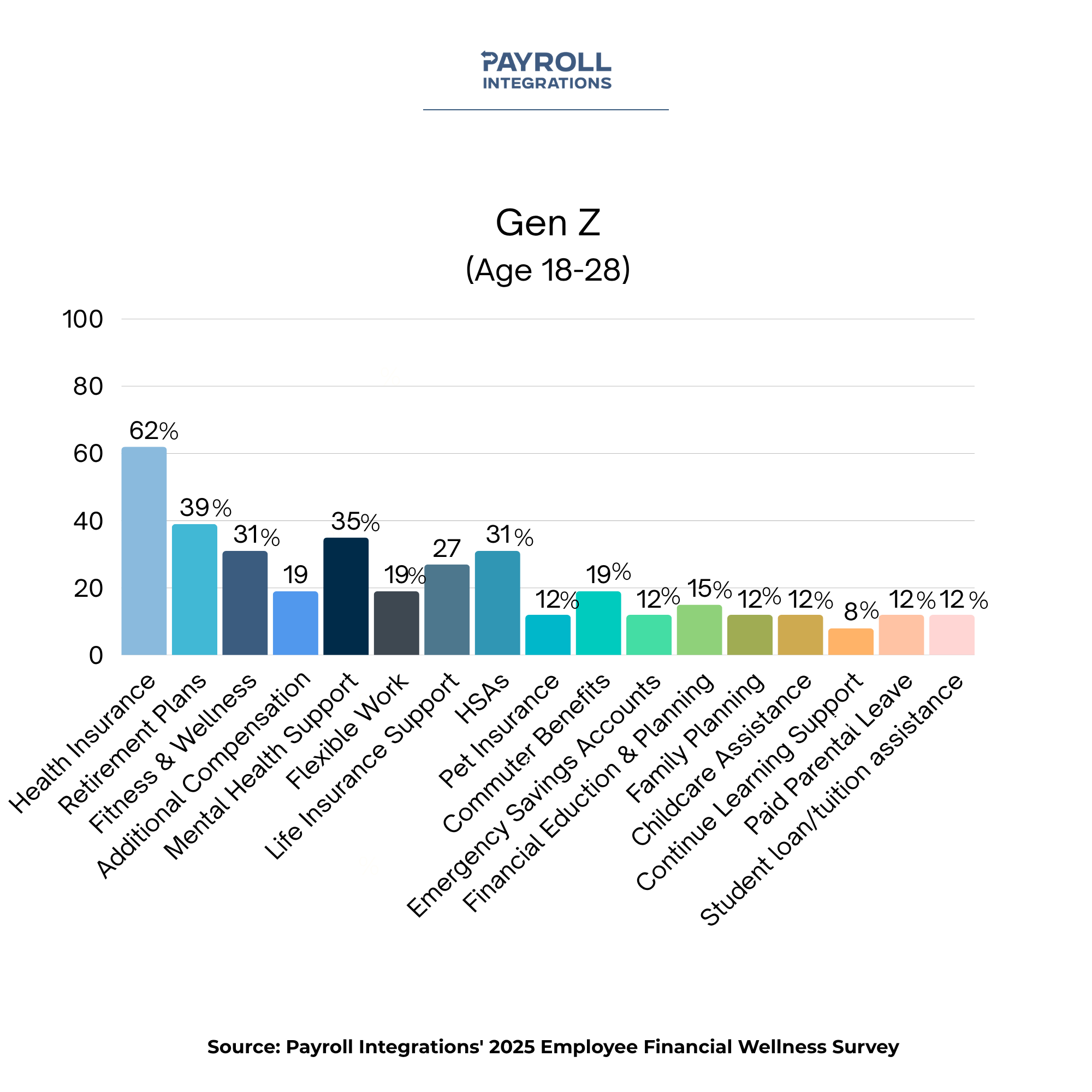

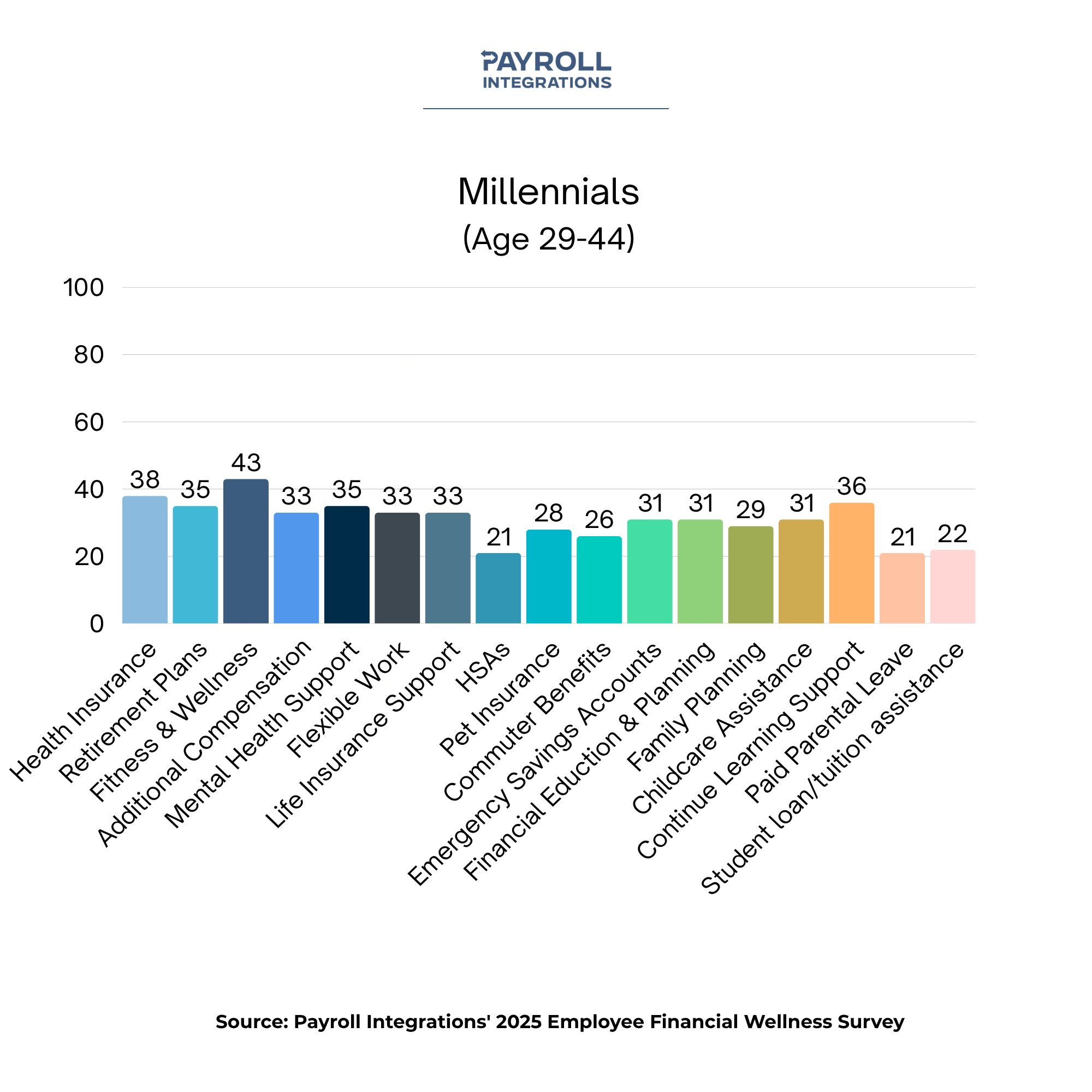

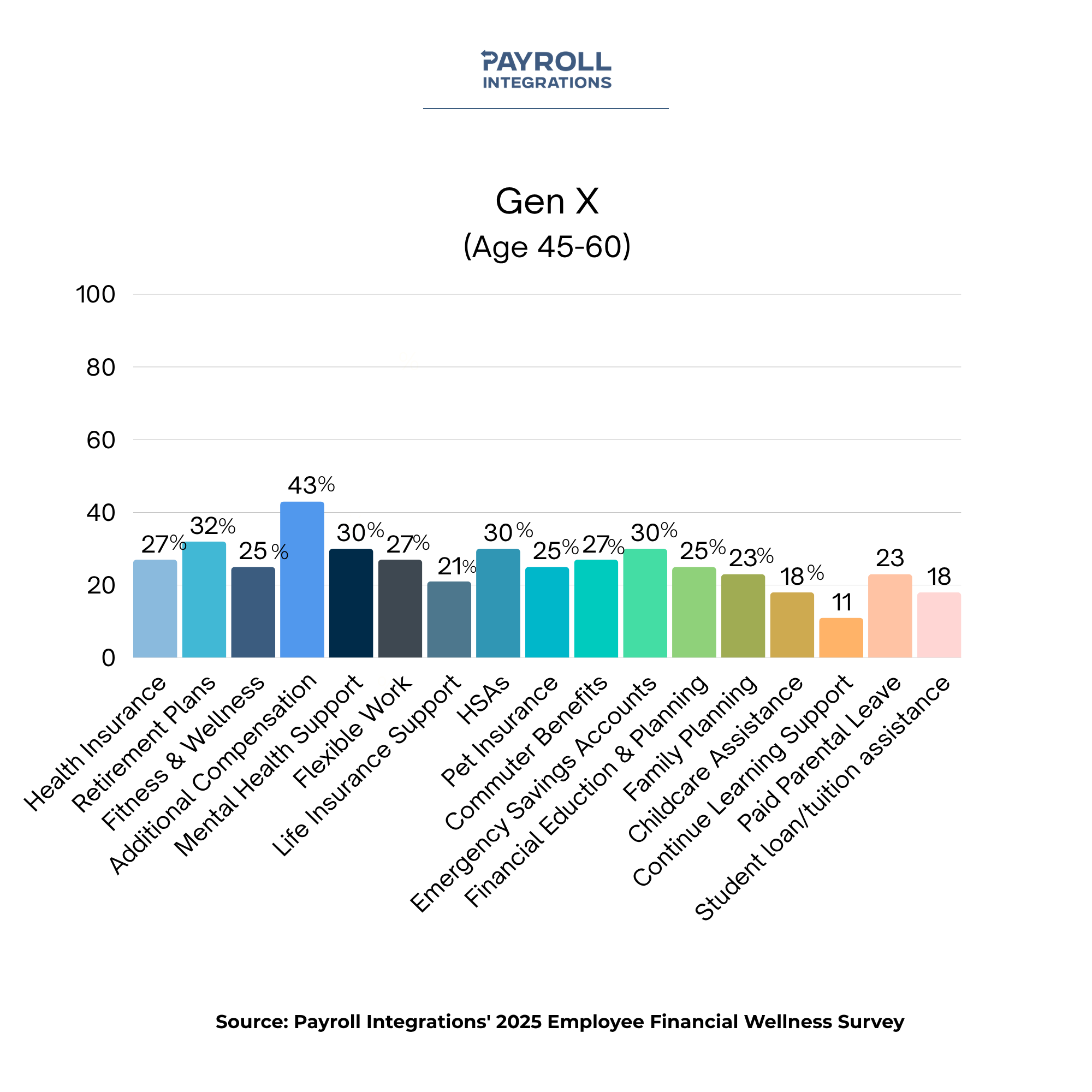

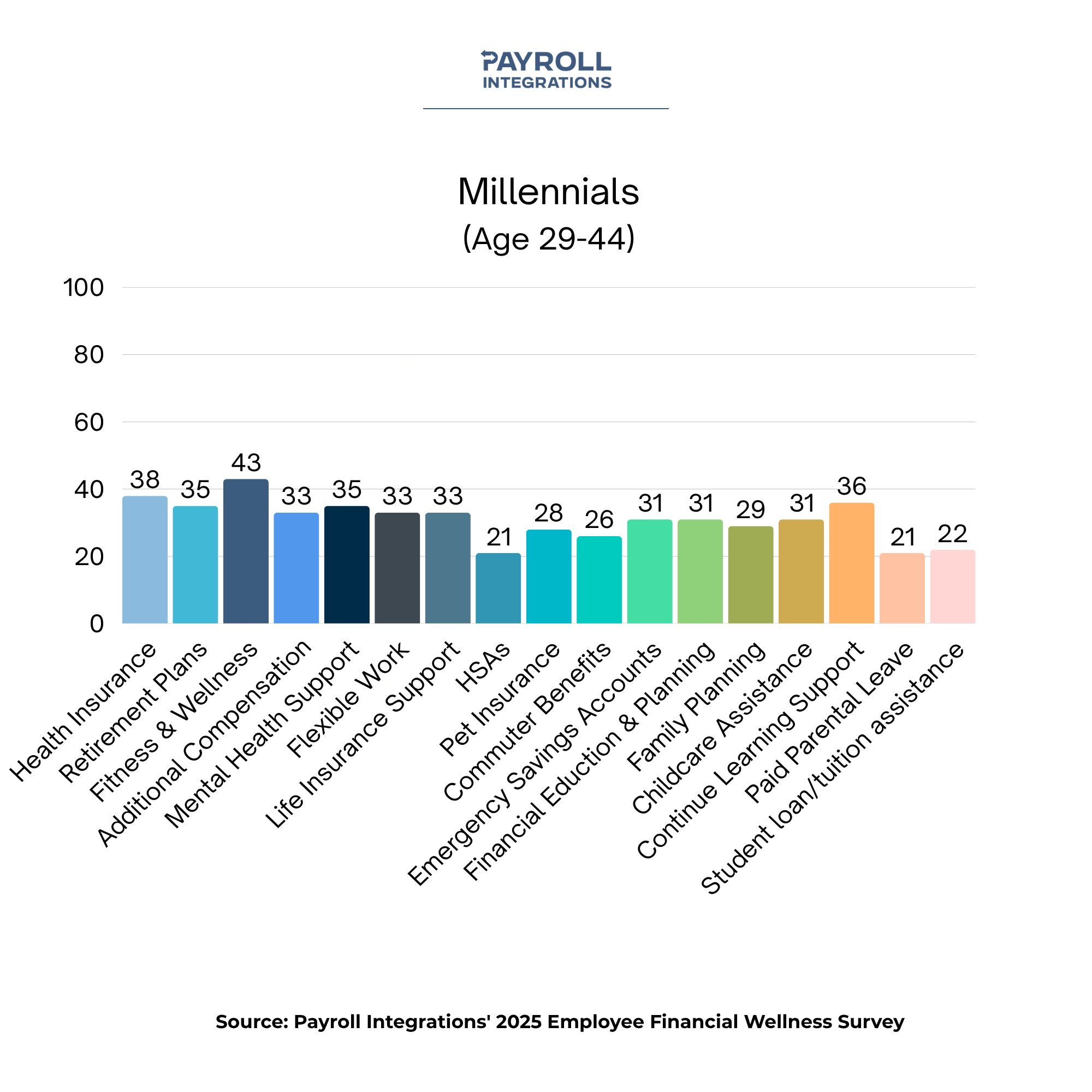

Most Wanted Benefits, By Age

What’s Keeping Employees Around?

The same benefits that often drive employees to leave are also the ones keeping them in place.

Strong health insurance (67%) is the #1 retention factor, followed by competitive retirement plans (53%) and family or parental benefits (53%).

Nearly half (49%) also say clearly communicated benefits play a key role in their decision to stay.

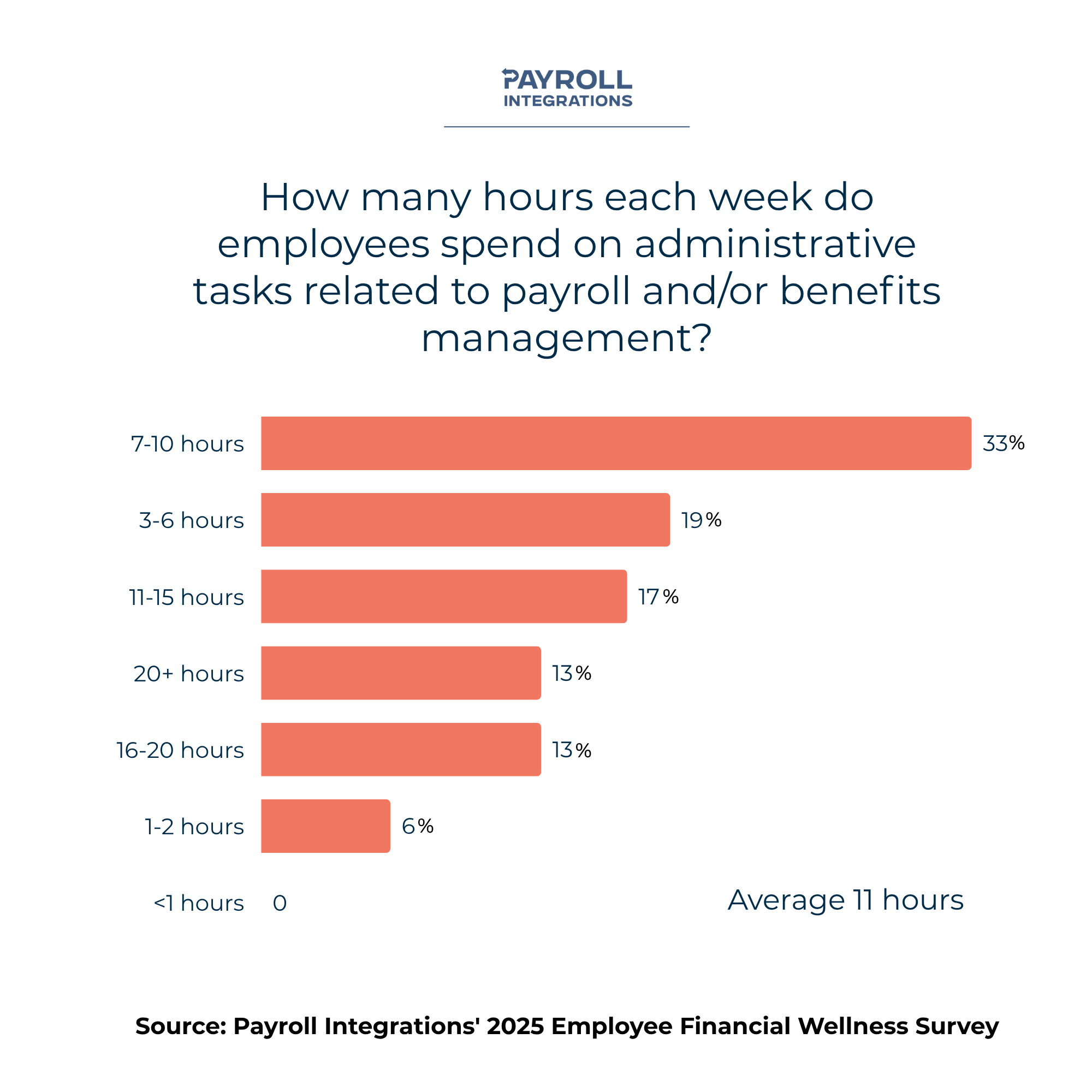

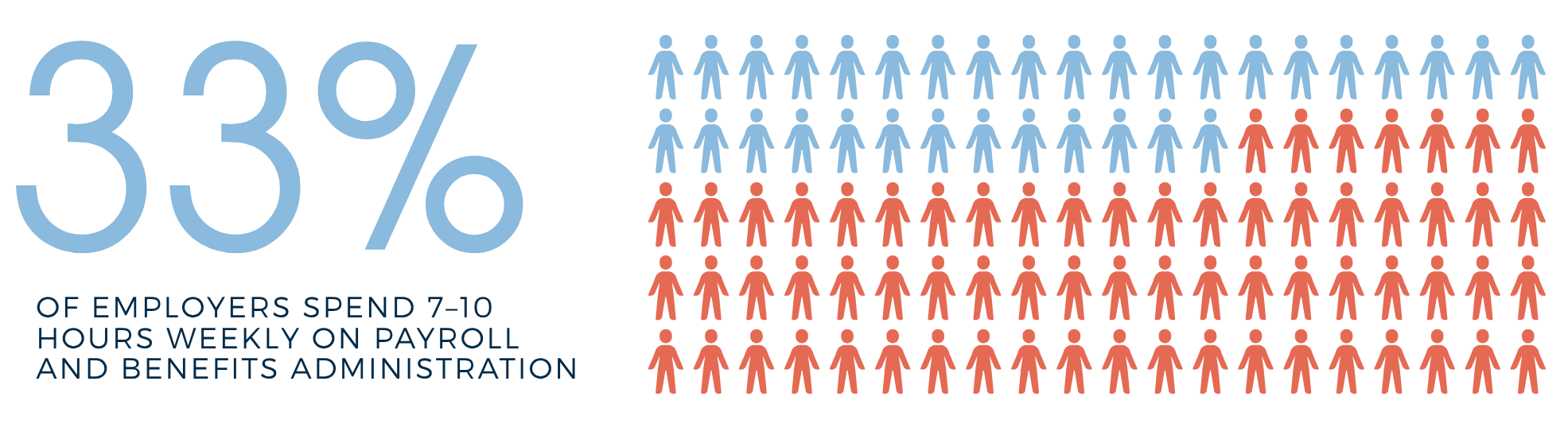

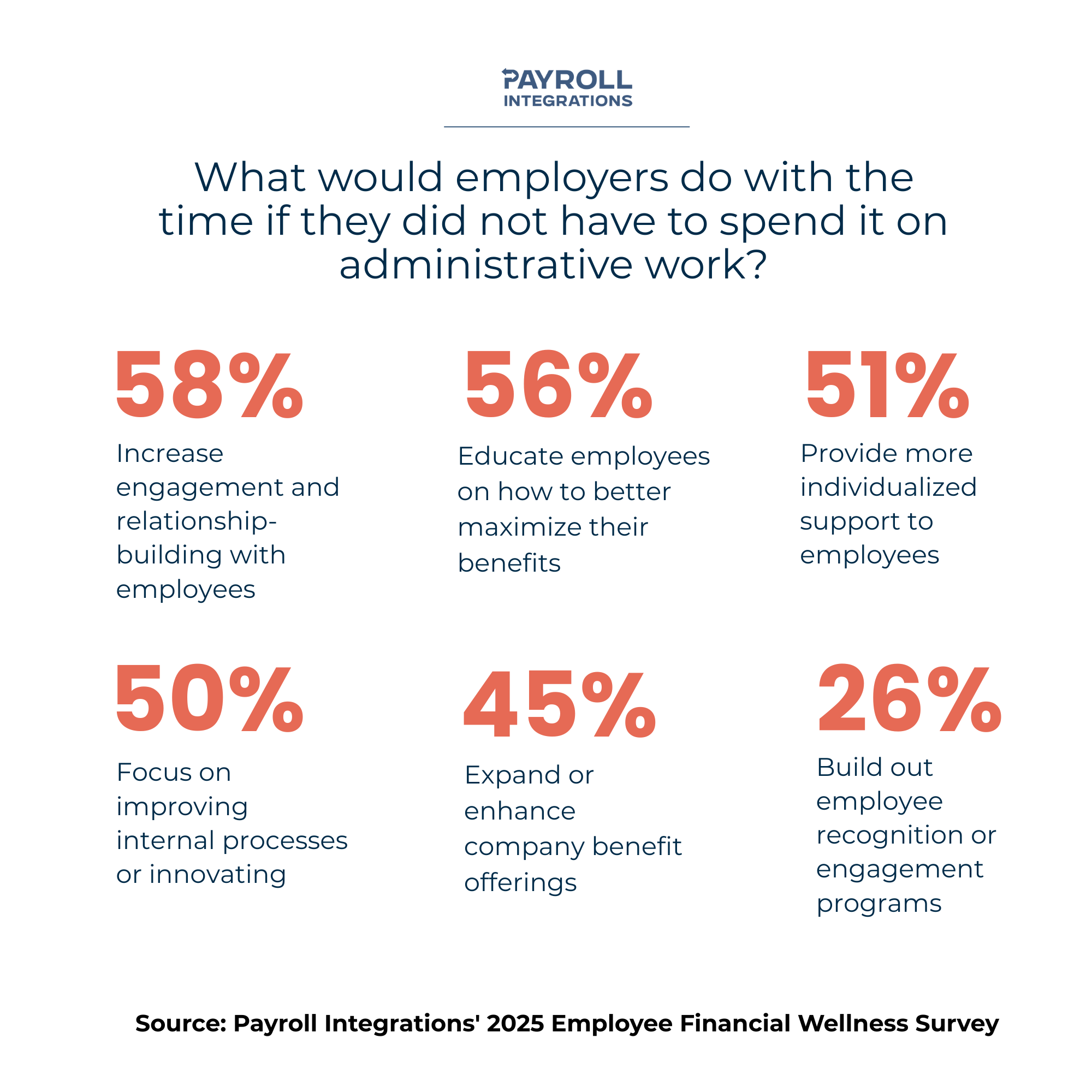

The Hidden Cost of Administration

Companies Are Spending Too Much Time on Admin — And Not Enough Time With Employees

Employers are caught between high expectations and administrative realities. Despite widespread tech adoption, managing compliance, costs, and benefit complexity consumes time that leaders would rather invest in employee relationships. The challenge for 2025: reducing admin burden to create space for meaningful support.

Weekly Hours Spent on Payroll and Benefits Administration

More than a third (35%) of HR teams say they spend too much time on manual administrative work–averaging 11 hours a week, on payroll and benefits administration.

If employers cut down their time spent on administrative work, they’d focus instead on speaking with employees about benefits (60%), boosting engagement and relationships (58%), and providing benefits education (56%).

Financial Strain on the Rise:

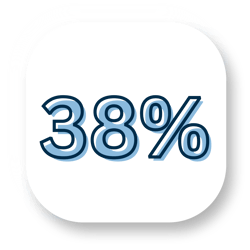

Payroll Integrations' 2025 Employee Financial Wellness report reveals a workforce under mounting financial pressure. Many employees are tapping into retirement savings as a lifeline, with 38% of workers stating they have withdrawn funds from their retirement accounts at some point.

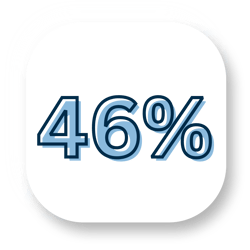

Such widespread withdrawals point to systemic financial insecurity, as workers cope with emergencies and high living costs in the face of insufficient safety nets. This trend cuts across demographics but is most acute among younger employees: nearly half of Gen Z workers (46%) have already dipped into retirement savings (versus 31% of Millennials). Crucially, these withdrawals are driven by urgent needs (not luxury spending): 37% of all withdrawals cover unexpected emergencies, and 42% of Gen Z withdrawals went toward paying off debt.

Alarmingly, this pattern is poised to continue, with one in three employees planning to raid retirement funds in the next year (often for emergencies or day-to-day expenses)–a sign of persistent financial fragility.

Key Findings:

have withdrawn from retirement funds

of Gen Z have withdrawn from retirement funds

plan to withdraw in the next 12 months

Have You Ever Withdrawn from Retirement?

- Withdrawals are widespread across the workforce. Overall, 38% of employees report having taken money from their retirement funds at least once.

- That figure climbs to 46% among Gen Z—the highest withdrawal rate of any cohort—while Millennials are lower at 31%, and Gen X and Boomers are tied at 41%.

- These splits suggest early-career workers face the most acute short-term pressures, with mid- and late-career workers not far behind.

Withdrawals are becoming increasingly common across the workforce and highest among Gen Z, indicating thinner financial buffers early in the career arc.

Reasons for Retirement Fund Withdrawals

Among employees who dipped into retirement savings this year, 37% used the funds to cover unexpected emergency expenses, such as major home or car repairs. This indicates that for many, a 401(k) or similar account has become an emergency fund of last resort.

Additionally, a significant share of younger employees are using withdrawals to manage debt – 42% of Gen Z who took out retirement money did so to pay off debt. By comparison, 6% of Millennials, 17% of Gen X and 0% of Boomers cited debt repayment as their reason, showing that this is disproportionately a Gen Z issue. These stats underscore that financial insecurity, not lack of discipline, is driving the behavior. Workers are encountering expenses or debt loads they can’t handle with regular income or savings, so they resort to raiding retirement funds, potentially incurring penalties or losses just to stay afloat.

Employees are using long-term savings to cover near-term shocks and inflation-driven pressures—signaling thin cash buffers across demographics and acute strain among younger employees.

Who Plans to Withdraw in the Next Year?

- Looking ahead, one in three employees expects to withdraw again in the next 12 months, indicating an ongoing pattern rather than a one-off event.

-

Planned withdrawals are broad-based, not confined to early-career workers.

- Top planned uses: emergencies (32%) and everyday costs (18%)